PZU effectively participates in the banking sector consolidation process. On 8 December 2016, PZU and PFR concluded an agreement with UniCredit to purchase 32.8% of Bank Pekao shares for the total amount of PLN 10.6 billion. The purchase price per share amounts to PLN 123. It was one of the largest transactions performed in the banking sector in Europe in the recent years.

Signing the Pekao S.A. share purchase agreement

On 8 December 2016, PZU and PFR concluded an agreement with UniCredit to purchase 32.8% of Bank Pekao shares for the total amount of PLN 10.6 billion. The purchase price per share amounts to PLN 123. It is one of the largest transactions performed in the bank sector in Europe in the recent years. Purchase of shares of Bank Pekao was associated with PZU’s aspirations expressed in the strategy of the Group until the year 2020, which assumes achieving the assets amounting to at least PLN 140 billion in bank sector and PLN 50 billion in management on behalf of third parties. PZU and PFR will cooperate in order to ensure effective realization of the Bank Pekao development strategy, while maintaining the current low-risk profile of the bank, sound profitability level and stable long-term policy concerning dividend payout from the result.

PZU and PFR concluded an agreement, which aims at: (i) building the long-term value of Bank Pekao, (ii) pursuing the policy to provide development, financial stability and effective yet prudent bank management towards the bank, as well as (iii) providing adequate standards of corporate governance for the bank. The point of the agreement was to set the rules of cooperation between PZU and PFR after the realization of Bank Pekao share purchase from UniCredit and the obligations of bank’s shareholders, especially in terms of determining the method of exercising the joint voting rights attached to Bank Pekao shares, as well as to manage the common long-term policy for the bank’s activity in order to achieve the abovementioned goals. Especially PZU and PFR mutually agreed to vote „for” adopting the resolutions concerning distribution of profit and dividend payout according to the rules and within the limits determined by the applicable provisions of law and PFSA’s recommendations and in line with the current practices of the bank.

Acquisition of the separated part of Bank BPH by Alior Bank

On 31 March 2016, ended the negotiations which resulted in Alior Bank signing the sale of shares and division agreement, which concerned the acquisition of the separated part of Bank BPH. The acquisition of the separated part of Bank BPH is in line with Alior Bank’s development strategy and is a significant step in the process of bank sector consolidation.

On 31 March 2016, ended the negotiations which resulted in Alior Bank signing with GE Investments Poland Sp. z o.o. (“GEIP”), DRB Holdings B.V. and Selective American Financial Enterprises, LCC (GE Capital Group) the sale of shares and division agreement, which concerned the acquisition of the separated part of Bank BPH. The transaction did not involve the purchase of the mortgage portfolio denominated in CHF, other foreign currencies and PLN, and the purchase of BPH TFI. The acquisition of the separated part of Bank BPH is in line with Alior Bank’s development strategy and is a significant step in the process of bank sector consolidation.

As a result of making an entry in the National Court Register, a legal merger of Alior Bank with the separated part of Bank BPH took place on 4 November 2016. This means that all other products for individual clients and products for business clients were transferred to Alior Bank, and their owners became the clients of Alior Bank.

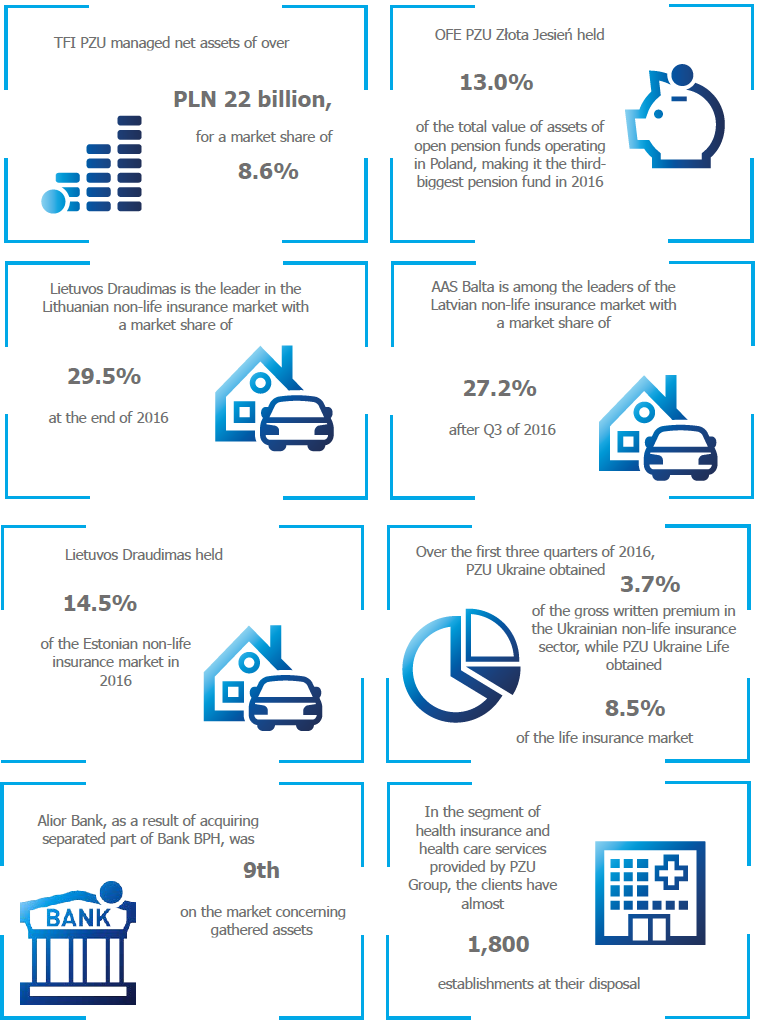

The acquisition of the separated part of Bank BPH is consistent with Alior Bank’s development strategy assuming growth basing on organic development and acquisitions. Due to the merger, Alior Bank was promoted to the 9th place among the largest banks in Poland in terms of asset value. At the end of December 2016, the amount of Alior Bank assets and the separated part of Bank BPH was PLN 46 billion and PLN 15 billion, respectively, which is PLN 61 billion in total.

Issue of Alior Bank shares

Acquisition of the separated part of Bank BPH was preceded by the issue of Alior Bank shares. The public offering of Alior Bank covered 56,550,249 new shares, whose issue price was set at PLN 38.90 per share. The issue was performed in observance of the pre-emptive right on the account of the existing shareholders of the bank. The value of the performed subscription amounted to PLN 2.2 billion, of which PZU’s involvement amounted to PLN 642 million. Hence, it has been the biggest public offering on the Warsaw Stock Exchange since 2013, and, simultaneously, the largest issue of shares with the pre-emptive right since 2009.

Market situation

As at the end of 2016, there were 36 domestic banks, 558 cooperative banks, and 27 branches of credit intuitions operating on the Polish market. The number of commercial banks dropped from the end of 2015 by 2 banks.

In 2016, the situation in the banking sector remained stable, which was facilitated by ongoing economic recovery and the environment of record low interest rates. As at the end of 2016, there were 36 domestic banks, 558 cooperative banks, and 27 branches of credit intuitions operating on the Polish market. The number of commercial banks dropped from the end of 2015 by 2 banks. It should be expected that the trend of consolidation in the bank industry will continue in 2017 due to the need for reaching an appropriate scale of activity to maintain operating effectiveness in the perspective of regulative costs and scale of investment expenditures required in association with the ongoing technological revolution, which imposes changes to the bank product and service distribution model.

In 2016, similarly to the previous years, the banking network diminished (by 0.2% to 14,434 locations) and the employment level dropped by 1.2%.

Between January and December of 2016, the banking sector generated a net profit of PLN 13.9 billion from the PLN 11.2 billion in the corresponding period of the previous year (up by 24.3%).

The net result of the sector was determined mainly by the growth of result on banking activity (to PLN 59.3 billion, i.e. up by 6.1% from 2015), which was produced by the considerable growth of the interest result (by 7.6%) with simultaneous decline of the result of fees and commissions (by 5.4%).

The interest result grew mainly due to the banks’ adaptations in the deposit and credit policy to the environment of low interest rates. There was a strong drop of interest costs (by 9.4% y/y) with simultaneous moderate growth of revenue from interest (by 2% y/y).

The considerable growth from other banking activity is mainly due to the settlement of the transaction covering the sale of shares in VISA Europe in Q2 of 2016 (additional revenue of PLN 2.5 billion).

The higher operating costs of banks in 2016 compared to 2015 was determined mainly by the growth of employee costs (by 2.7% to PLN 15.6 billion) and growth of general management costs associated mainly with the introduction of the tax on certain financial institutions (the so-called bank tax) on 1 February, which was partially offset with additional payment to BFG in December of 2015.

The total value of assets of the banking sector as at the end of 2016 reached PLN 1,711.3 billion and was 7.0% (i.e. PLN 111.3 billion) higher than at the end of 2015. The main areas of asset growth included the portfolio of assets available for sale and credits while the main areas in liabilities were deposits from households and the budget sector.

The value of equity in the banking sector for capital ratios measured in accordance with CRR regulations amounted to PLN 172.3 billion at the end of September 2016 and rose by 15.4% from the end of September of 2015. The growth was related to the decision of certain banks to retain 2015 profits, exclude the financial data of Sk Bank from reporting, and new emissions of shares.

The total capital ratio of the banking sector reached 17.58% at the end of September 2016 (a growth by just over 2 p.p. compared with the end of September 2015) and the Tier I core capital ratio amounted to 16.01% at the end of the above-mentioned period (an increase by roughly 1.8 p.p. from the end of March of 2015).

Activity of Alior Bank

Alior Bank is a universal bank that is recognizable for its state-of-the-art solutions and a wide product offer. In 2016, Alior Bank Group generated PLN 618 million in net profit per shareholders of the parent entity and reached ROE of 12.7% (including one-off events).

The produced financial result was determined by the Bank’s operating activity driven by organic growth of the balance total resulting from credit sales (net organic growth of consumer credits in 2016 amounted to PLN 6.9 billion) and the acquisition of the separated part of Bank BPH (entailing growth of the credit portfolio by PLN 8.5 billion).

Due to the consolidation of the financial results of Alior Bank with the financial results reached by the separated part of Bank BPH between 4 November and 31 December of 2016, the revenue of Alior Bank grew by PLN 133 million and its operating costs grew by PLN 81.3 million.

Furthermore, the revenue takeover saw Alior Bank raise its profit with the acquisition of the separated part of Bank BPH, raising its revenue in 2016 by PLN 508 million. Simultaneously, the decision was made to establish a restructuring provision of PLN 268 million in the 2016 financial result.

The main source of the Group’s income in 2016 was the net interest result, which, despite pressure of low interest rates and thanks to the dynamic growth of the credit operation resulting from the merger with the separated part of Bank BPH and organic development combined with efficient management of the Bank’s price policy, grew annually by PLN 445 million to PLN 1,946.0 million, i.e. by 29.6%.

The Group also recognizes the result from fees and commissions as a major source of income in 2016 as it reached PLN 331.1 million (a minimum year on year drop) and had the share of 10.4% in the income generated in 2016. Furthermore, the Group’s revenue generated in 2016 was considerably impacted by the result on trading activity, which composed 10.1% of revenue, specifically the result generated with transactions on the currency market and interest rate transactions made for the benefit of the clients.

The 2016 Costs/Income index was 49.1% compared to 51.1% in 2015 (excluding one-off events associated with the merger with the separated part of Bank BPH).

Considering the effective implementation of processes crowned by the acquisition of the separated part of Bank BPH on 4 November of 2016 with simultaneously operated business activity considerably raising the operating scale of Alior Bank, the Management Board sees the operating activity of 2016, the acquisition and progress of process aimed at the operating fusion with the separated part of Bank BPH, and the 2016 financial results as positive. According to the Alior Bank Management Board, they are stable foundations for consistent and safe development of the Bank in the upcoming years.

Products and services

The activity of the Bank is performed within different units, which offer certain products and services intended for certain segments of the market. At present, the Bank is managing its activity in the following industry segments:

- individual client (retail segment) – intended for the market of mass client, meaning wealthy and very wealthy clients, to whom the Bank offers whole range of bank products and services and brokerage products offered by the Broker Office of Alior Bank S.A, especially credit products, deposit products and investment funds, personal accounts, bancassurance products, transaction services, and foreign currency products;

- business client (business segment) – for SMEs and large corporate clients, to whom the Bank offers full scope of bank products and services, especially credit products, deposit products, current and secondary accounts, transaction services, and treasury products;

- treasury activity – includes operations on interbank markets and involvement in debt securities. This segment reflects the results of managing the global position (liquidity position, interest rates position and currency position resulting from bank operations).

New products and services

In April 2016, Alior Bank also extended the scope of cooperation with BGK under the de minimis program, introducing the POIG BGK guarantee for financing innovative projects with recognition of their character in terms of needs of financing current and investment activity. Thanks to this, the entrepreneurs planning investments in new technological enterprises can count on getting a credit within their current account intended for current financing as well as an investment credit, and the payment is secured with POIG BGK guarantee.

In addition, in June 2016, Alior Bank provided a new website for entrepreneurs, zafirmowani.pl, thus offering its clients additional services, such as free application which allows them to keep simplified accounts on their own (Income and Disbursement Register), or invoicing system. In addition, thanks to cooperating partners, the website presents special offerings for the clients and publishes articles and manuals related to certain aspects of managing business. Thanks to social functionalities, it allows establishing relations between registered entrepreneurs and giving recommendations under shared economic operations. The new tool will support the entrepreneurs in terms of accessing new internet tools, enhance exchange of information related to changes of regulations within business environment, as well as provide a new form of establishing business relations.

New relevant operations

On 7 August 2015, Alior Bank signed an agreement with Romanian service provider Telekom Romania Mobile Communications from Deutsche Telkom Group. Hence, the Bank extended its strategic alliance with global telecommunications operator with another market from Central Europe.

On 14 January 2016, the National Bank of Romania (Romanian bank regulator) registered Alior Bank S.A. Varsovia – Sucursala Bucuresti as a branch of foreign credit institution within the meaning of Directive 2013/36/EU, under the number RB-PJS-40-071/14.01.2016. Therefore, one of the conditions included in the agency agreement with Telekom Romania Mobile Communications was fulfilled.

In 2016, with the decision of the Polish Financial Supervision Authority, Alior Bank acquired SKOK Powszechna and SKOK Wyszyńskiego. The decision of the committee means that the Management Board of Alior Bank SA is responsible for managing the assets of SKOK Powszechna and SKOK Wyszyńskiego. SKOK named after Cardinal Stefan Wyszyński had 34 thousand members, over PLN 180 million in deposits and has a network of 20 branches, while SKOK Powszechna – 23 thousand members and PLN 42 million in deposits, respectively.

On 13 March 2017 Alior Bank announced its strategy for the years 2017 -2020 - „Digital disruptor”. It assumes a further increase in the importance of innovation in the development of the bank, through ia. implementation of cutting-edge technology solutions to support the customer and the employee. In addition, Alior Bank intends widely used the digital revolution on other places of action- setting trends in modern banking.

Factors, including risks and dangers, which will impact the activities of Alior Bank in 2017

The situation in the banking sector in 2017 will primarily be affected by:

- new tax burden applicable as of 1 January 2016 resulting from the tax on certain financial institutions, see more;

- the Financial Stability Committee’s adoption of the resolution on recommendations for restructuring the house credit portfolio in foreign currencies in January of 2017.

- several risk factors in the external environment of the Polish economy;

- gradual raising of contributions paid by Banks to BFG over the past several years;

- macroeconomic situation in the Polish economy – increase in the Gross Domestic Products, as well as the employment and salary level, accompanied by historically low interest rates and low energy materials, positively affects the level of generated volume of credits and quality of credit portfolio.