Premiums

In 2016, PZU Group collected gross premiums of PLN 20,219 million, i.e. 10.1% more than in 2015.

Within particular segments, the following trends were recorded:

- sales in mass-client segment higher by PLN 1,433 million (excluding premium between segments) compared with 2015, including in particular motor insurance, as a result of an increase in average premium and the number of insurance policies;

- higher sales in the corporate client segment than in 2015 by PLN 371 million (excluding premium between segments), including mainly within motor insurance due to the increased average premium and number of insurance policies and in fire and non-life insurance as well as other TPL (resulting from the acquisition of several individually significant agreements);

- growth of sales in the group and individually continued insurance segment – periodical premium higher by PLN 86 million, mainly due to the development of group protection insurance (an increase in average premium and the average number of additional insurances) and acquisition of the premium in group health insurance (new clients in ambulatory insurance);

- in individual insurance segment, premium lower by PLN 60 million compared with the previous year, mainly in individual unit-linked products in the bancassurance channel;

- increase in written premium collected by foreign companies by PLN 31 million compared with 2015, including mainly the development of sales in the Baltic states segment offset by the disinvestment of PZU Lithuania in September 2015.

Net revenue from commissions and fees

Fee and commission net revenue in 2016 contributed PLN 523 million to PZU Group’s result, which is PLN 280 million more than in the prior year. Fee and commission revenue comprised mainly:

- fee and commission net revenue paid for the banking activity in the amount of PLN 330 million, including mostly: brokerage commissions, revenues and expenses related to handling bank accounts and payment and credit cards, remuneration for insurance policy sale intermediation;

- OFE Złota Jesień asset management fees. These amounted to PLN 93 million (drop of 7.9% in comparison with the previous year resulting from PZU’s OPF net assets decline);

- income and fees from investment funds and fund management companies of PLN 102 million, i.e. PLN 13 million less than in the previous year, mainly in relation to the change in the number of the funds included in consolidation as compared with the corresponding period.

| Insurance segment | Gross written premium | ||||

|---|---|---|---|---|---|

| PLN million, local accounting standards | 2016 | 2015 | 2014 | 2013 | 2012 |

| TOTAL | 20,219 | 18,359 | 16,885 | 16,480 | 16,243 |

| Non-life insurance – Poland (externally written premium) | 10,878 | 9,074 | 8,367 | 8,269 | 8,451 |

| Mass client insurance- Poland | 8,742 | 7,309 | 6,560 | 6,534 | 6,614 |

| Motor TPL | 3,635 | 2,595 | 2,373 | 2,453 | 2,567 |

| Motor own damage | 2,147 | 1,727 | 1,579 | 1,549 | 1,598 |

| Other products | 2,960 | 2,987 | 2,608 | 2,531 | 2,449 |

| Corporate insurance- Poland | 2,136 | 1,765 | 1,807 | 1,735 | 1,838 |

| Motor TPL | 532 | 367 | 354 | 372 | 394 |

| Motor own damage | 712 | 510 | 461 | 479 | 544 |

| Other products | 892 | 888 | 992 | 885 | 899 |

| Total life insurance – Poland | 7,949 | 7,923 | 7,808 | 7,745 | 7,454 |

| Group and continued insurance – Poland | 6,775 | 6,689 | 6,539 | 6,415 | 6,364 |

| Individual insurance – Poland | 1,174 | 1,234 | 1,269 | 1,330 | 1,090 |

| Total non-life insurance – Ukraine and Baltic states | 1,305 | 1,288 | 632 | 388 | 338 |

| Ukraine non-life insurance | 173 | 138 | 133 | 157 | 142 |

| Baltic states non-life insurance | 1,132 | 1,150 | 499 | 230 | 196 |

| Total life insurance – Ukraine and Baltic states | 88 | 74 | 78 | 78 | - |

| Ukraine life insurance* | 37 | 31 | 41 | 47 | - |

| Lithuania life insurance* | 51 | 43 | 37 | 32 | - |

Structure of the Group PZU’s gross written premium (in %)

Net investment result and interest expenses

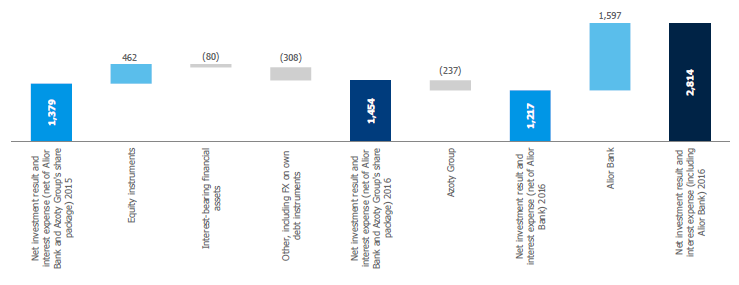

In 2016, PZU Group’s net investment result amounted to PLN 3,587 million compared with PLN 1,739 million in 2015 (increase of 106.3%). The higher result is mainly the effect of including the banking sector activity (i.a. interest income, including the one from loans, and trading income), due to the commencement of Alior Bank consolidation. After taking into account interest expenses and excluding the contribution of Alior Bank and Azoty Group’s share package, net investment result in 2016 amounted to PLN 1,454 million and was higher than the result of the previous year by PLN 74 million, mainly due to the following factors:

- higher result on equity instruments, especially because of the upturn on WSE – the WIG index grew by 11.4% compared with the drop of 9.6% in the corresponding period of the previous year;

- drop in revenue from interest-bearing financial assets at fair value mainly due to decrease in value of Polish treasury bonds – resulting primarily from changed perspectives for global interest rates;

- lower portfolio of bonds held until maturity resulting from temporarily lower level of reinvestments in the environment of low interest rates;

- high level of negative exchange differences on own debt securities resulting from appreciation of EUR exchange rate against PLN is balanced with simultaneous increase in value of the assets portfolio denominated in EUR.

As at the end of 2016, the value of PZU Group’s investments portfolio1 excluding the contributions of Alior Bank amounted to PLN 50,407 million compared with PLN 52,248 million as at the end of 2015.

Investing activities of PZU Group are conducted in compliance with the statutory requirements, ensuring an appropriate degree of safety, liquidity and profitability; therefore, treasury debt instruments accounted for more than 60% of the investments portfolio excluding Alior Bank both as at 31 December 2016 and 31 December 2015.

In 2016, PZU Group’s investment activity focused on continuing realization of strategic objectives, including optimization of investment activity profitability through increased diversification of the investment portfolio.

Change of the net investment result following the recognition of interest-bearing costs (PLN million)

Structure of the investment portfolio excluding the contributions of Alior Bank* (in %)

Other operating income and operating expenses result In 2016, the balance of other net operating income and expenses was negative and amounted to PLN 740 million compared with the also negative balance for 2015 of PLN 419 million. The following factors affected this result:

- inclusion of Alior Bank in the results of PZU Group and merger of Alior Bank with separated part of BPH, including recognition of restructuring costs reserve associated with said merger in 2016 in the amount of PLN 268 million;

- introduction of the tax on financial institutions – PZU Group was encumbered (both in its insurance and banking activity) with this tax in the amount of PLN 395 million in 2016;

- recognition of the costs of depreciation of intangible assets identified as a result of the acquisition of Alior Bank shares by PZU amounting to PLN 46 million and separated part of BPH (PLN 2 million)

The above factors were partially compensated with:

- profit from the bargain acquisition of the separated part of Bank BPH for PLN 508 million, including the following: difference between the purchase price and the acquired net assets according to the accounting value of PLN 282 million; fair value measurement of asset and liability components in the amount of PLN 313 million;

- PLN 119 million lower costs of depreciation of intangible assets identified as a result of the acquisition of insurance and health care companies.

1 Investment portfolio consists of financial assets (along with investment products, excluding loan receivables from clients), investment property (including the part recognized under Assets held for sale), negative measurement of derivatives, and liabilities from sell-buy-back transactions.